According to just about every social, political and economic commentator in the country, we have an abysmal rate of saving. In the past, only economists and the Reserve Bank Governor said this. However, it seems that these cries were ignored. Not many people are going to listen to advice from a gloomy old economist or Reserve Bank Governor when they are thinking about buying a new TV.

Now However, it seems that insulting some of our ingrained habits is the "in" thing at the moment. Apparently we are terrible drivers and apparently we are terrible savers. but has this increase in derision at our poor level of saving (combined with the recent recession), increased our rate of saving?

Well maybe it has. Since 2007 retail sales figures have struggled to gain momentum (see chart below). You could argue that this is due to high unemployment figures, but there is another more basic piece of evidence to suggest our savings rate has gone up in recent times: Trade surpluses.

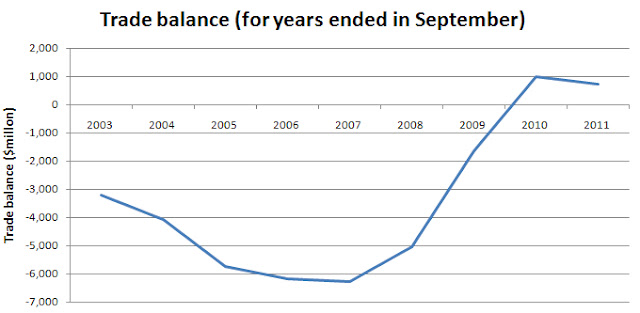

As you can see in the chart below, New Zealand has had a better trade balance in recent years, suggesting that our spending has decreased and saving increased.

So if our saving rate has gone up, what does this mean for the country? well in economist terms, it could mean that we experience an increase in our steady-state rate of growth, which I will proceed to explain by example.

Suppose we have a person earning a constant $100 000. They decide to spend 80% of what they earn and save the remaining 20% at an interest rate of 7%.

In year one they will earn $100 000, spend $80 000 and save $20 000.

In year two they will earn $100 000 plus $1400 (interest income $20 000 X .07), spend $81 120, and save $20 280.

Over time, their expenditure over a 40-year period will look like this:

So expenditure increases over time which is nice. In this example, income and expenditure is increasing at a rate of 1.4% each year, which is the steady-state rate of growth.

But what if this person decided after ten years to increase their savings rate to 50% of income? We would get the situation with the red line in the figure below.

In the years immediately following the saving rate change, expenditure drops sharply, but eventually catches up to and overtakes the amount of spending that would have taken place (dashed line) due to the increase in income from saving dividends. In this example the steady-state rate of growth has increased to 3.5%.

If we use this example to discuss the New Zealand economy (approximating expenditure to Gross Domestic Product, or GDP) then the shaded area in the above chart is where I think our economy is now, given my earlier theory of an increase in savings. If this is true, then the current stagnation in GDP and high unemployment figures are partly caused by a change in spending/saving rates. However, this should only be temporary, and GDP in a relative sense will increase as the dividends from our extra savings start to kick in (and as our steady state rate of growth improves).

Of course, this model is only an example. It can only reflect a few aspects of reality and it has some limitations:

- The time needed to "overtake" the dashed line in the real world could be more or less that that taken in the example, where only arbitrary numbers were used.

- The New Zealand economy is not just affected by the saving rates of different citizens, but by other global and domestic events, making the situation not quite as straightforward as that described by this post.

- For the increase in the steady-state rate of growth to be permanent, individuals and governments need to stick with the habit of saving at the increased rate. I have serious doubts that this will happen.

In conclusion, global and domestic events may make the picture on saving and spending a little murky. Murky or not however, an increase in saving will definitely help improve prosperity and the long-term future of New Zealand.

No comments:

Post a Comment